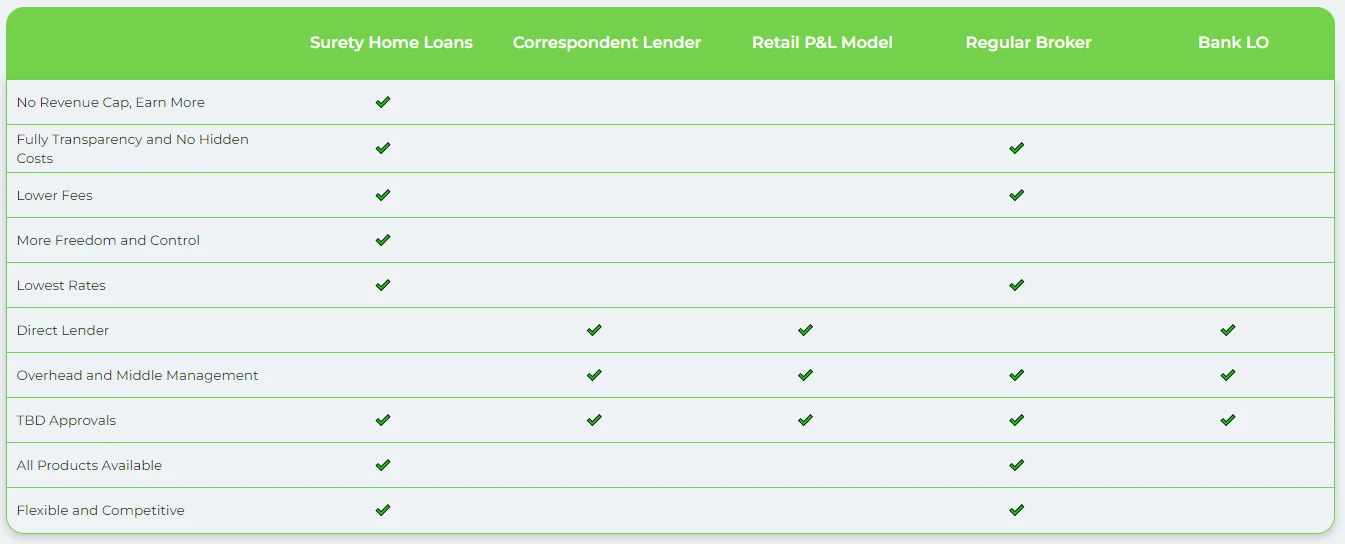

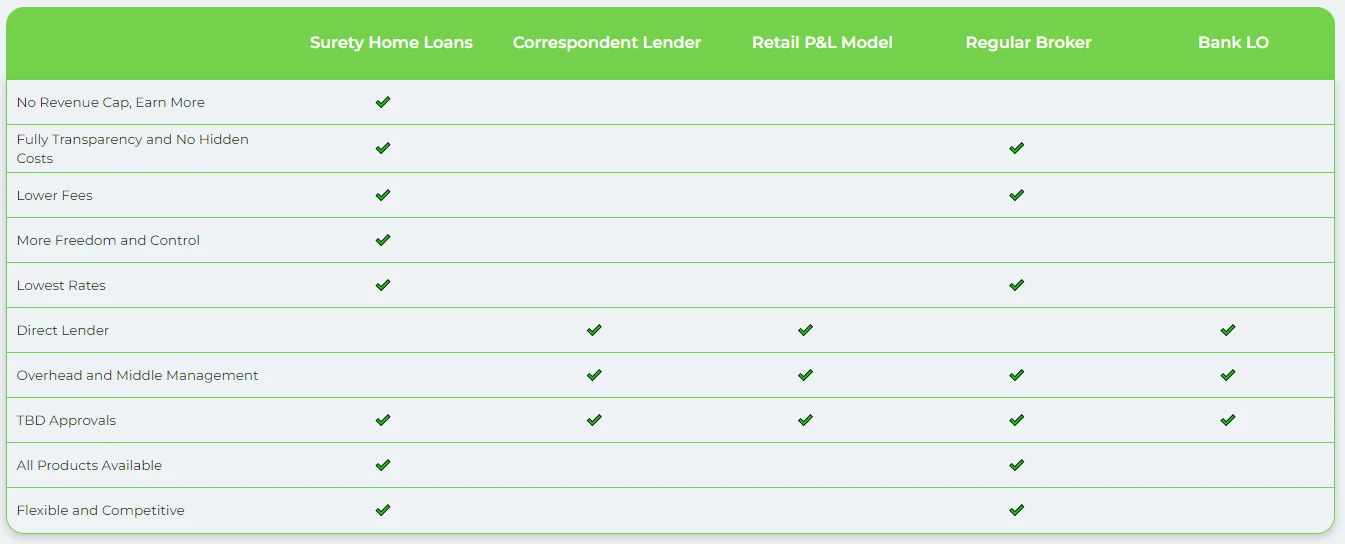

Why Surety Home Loans?

Our P&L branch model with full control of structure, staffing, expenses, and overall management of your team. DBA’s are also allowed.

A conventional loan is a type of loan that is not insured by the government. Conventional loans offer more flexibility and fewer restrictions for borrowers, especially those borrowers with good credit and steady income.

FHA home loans are mortgages which are insured by the Federal Housing Administration (FHA), allowing borrowers to get low mortgage rates with a minimal down payment.

VA loans are mortgages guaranteed by the Department of Veteran Affairs. These loans offer military veterans exceptional benefits, including low interest rates and no ...

A jumbo loan is a mortgage used to finance properties that are too expensive for a conventional conforming loan. The maximum amount for a conforming loan is $766,550 in...

Debt Service Coverage Ratio (DSCR) loans are a type of financing typically used by real estate investors and businesses to qualify for a loan based on the property's income-producing ability, rather than the borrower's personal income.

A reverse mortgage is a type of loan designed for homeowners who are typically 62 years or older, allowing them to convert a portion of their home equity into cash without having to sell the home or make monthly mortgage payments.

Bank statement programs are a type of mortgage financing designed for self-employed individuals, freelancers, business owners, and others with non-traditional income sources who may have difficulty qualifying for a conventional loan based on tax returns or W-2 forms.

We have many other programs as well to suit everyone's needs.